Written by Thomas Mutsimba, an Enterprise Risk Management Professional, endowed with advanced forensic analysis and advanced actuarial analysis©

Visit ThomasActuarialanalysisworld Blog for more cutting edge insights @ https://actuarialanalysisworld.finance.blog/

This short-paper addresses whether COVID-19 inspired risks are the same as existing and or forecasted enterprise risks. In light of the prevailing risk universe in the form of COVID-19, questions may be posed by Boards and their Committees regarding the reliability and relevancy of the enterprise risk assessments. In this paper I explore what Risk management committees, Chief Risk Officers, Risk Managers, Chief Executives and Risk Officers may do to enable buoyancy in adjudicating the existing risk management processes. I use what is known as the Gap Identification Measurement technique. The Gap identification measurement techniques using the intensity-extremity quotient that permeates the risk diametric velocity as risk management processes are suspended and deployed to counter COVID-19 inspired threats. Risk universes, either COVID-19 or enterprise specific move along the strategic line of sensitivity impacted by the Strategic objectives of the organization. Organizations must dwell on the pre-cursor six principles. Challenges organizations face in the permeating risk universes are the stagnation threat of innovation in risk analysis and assessment techniques. However, innovation does not only cover reinvent the wheel, but it covers compartmental efficiency dynamics along the degenerative risk assessment processes. The following is a list of six principles that any organization may focus on:

- Wheel of spiky data formulation;

- Data algorithmic meaning;

- Risk factor quotient rate convulsive at rate of velocity of gap measurement;

- Nine-factor authentication measurement;

- Generating denominational quotient;

- Statistical distribution efficient factor;

I expound the principles to demonstrate the Gap identification measurement technique:

1. Wheel of spiky data formulation

The wheel of spiky data phrase and or metaphor out posturing refers to the sensitivity element of risk data that is creating forms of gaps in the identified, approved or official risk assessment measurement techniques. Data; at least not all of it is useful but data formulated and channeled as the lesser concomitantly postulated strategic objectives may result in emerging COVID-19 inspired risks filtering through the universe without the risk analysis sieving effect. However here we note that perennial risk analyses are stagnant risk assessment techniques that never evolve in tandem with the dynamic risk universe. Wheel of spiky forms data for risk quality actualization. Here I represent the effective nature of COVID-19 inspired risks on the risk assessment processes. It may not be COVID-19 but other sudden or immediate risk assessment in waiting, risks that require the entity and its Board attention. This attention is not attention to the risks per se but attention to the quality of risk analytics to be able to identify and measure risks. Many organizations today like to play it safe rather adopt a conservative approach in the risk analyses imperatives. The result of a conservative approach widens the gap quotient created by the quality of risk analytics.

2. Data Algorithmic meaning

What is data algorithmic meaning? This refers to the data meaning driving methodology as the data, particularly moves along the line of sensitivity in the risk universe. How is your entity making use of key data and assumptions the universe is emitting? There is data that has certain qualities and there is data with another set of qualities. Therefore, the modus pock or initial data meaning populative capability must be imperialized in order to ensure that risk universe exposure to the official risk assessment. What is now the significance of COVID-19 data algorithmic meaning? Organizations must answer this question. This question will be answered in the organization’s contextualized key data and assumptions it employs in carrying out a COVID-19 inspired risk analyses.

3. Risk Factor Quotient rate convulsive at rate of velocity of gap measurement rate

Risk factor quotient rate: what is it? This is the risk analytic deficient compartmental efficiency gap that postures itself as the risk(s) perspires factorial event lead indicators. The lead indicators I am talking about are convulsed at the voluminous impactive nature of the datum line of skewness of where the strategic imperatives are heading. This dissected at risk quantum analysis enables the organization to qualitatively and quantitatively quality assure the risk assessment and or risk analysis rate. Formulation of risk analyses does not happen because risk trigger event(s) such as COVID-19 have occurred, but it happens because COVID-19 arrests the velocity quotient. This velocity quotient is the one that is encapsulated in the analytics deficient compartmental efficiency gap.

The velocity of gap measurement rate is quite critical to the risk analyses methods. Why is it critical? It is critical because of the asymptomatic populative difference between the existing and or forecasted enterprise and the COVID-19 inspired risk analyses. The convulsivity of the Risk factor quotient measured at the gap measurement rate is a subject of the formula proportional dynamics. What does this mean? Here in this paper I am elucidating quantum risk dynamics that may be applied within a small to medium enterprise as well as the large enterprises. The complexity of this risk knowledge is not the complexity or the big worded type of element but what is complex is the availability and or the quality-sapphired applicability of COVID-19 inspired risk analyses in the quest to close the risk analyses gap measurement.

4. Nine Factor authentication measurement

The nine-factor authentication measurement is indeed a nine-step veracity checking mechanism. Voluminously nine steps require a separate paper to explain the nine step dynamics that must be looked at. However, the thrust of this authentication measurement is to elucidate the fluidity and or buoyancy of the designed risk analytics to usurp qualities of the metrics extracted from the measures to accost the outcomes. What is being accosted here? It is the quantum quality traits of the analyses that inform decision making. How many organizations today are applying such quality dynamics? The question remains and to be answered through examination of the organization’s floatation mechanism for risk analyses. For organizations today yearn for quantitative quantum risk measurement techniques that reveal the encapsulated organization quality decision making.

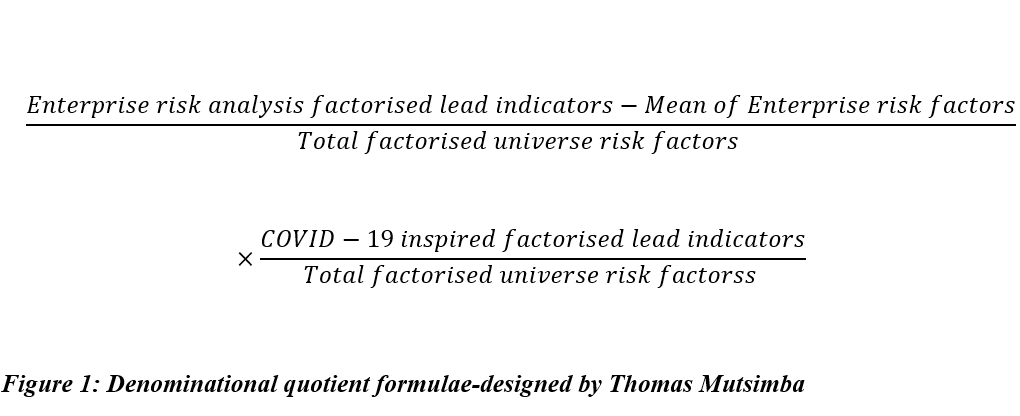

5. Generating denominational quotient

First we need to define generating denominational quotient. This refers to the perspiration dynamics of the envisaged and selected risk analyses motion sensory technique in an entity’s data science. The denominational quotient is a datum calculative portion centered deviation of movement from an existing risk infrastructural analysis to the desired strategic objectives which are denoted by the mean co-efficient posturing the bi-variance of risk factors measured at the existing and or forecasted enterprise risk analyses against the COVID-19 inspired risk analysis. The quotient formulae are as follows:

From the above denominational evident formula, the thrust is to depict motion movement from the current enterprise risk analysis to the COVID-19 inspired risk analysis. But one would ask a question : how does one use the generating denominational quotient and what is the meaning of the result of the above formula? Since the denominational quotient dynamics measures the movement quotient dynamics in the analytics measurement base, one can use it by development of an indexing framework that will combine each of the following:

- Enterprise risk analysis factorized lead indicators.

- Total factorized universe risk factors.

- COVID-19 inspired factorized lead indicators.

The indices developed for each of the above factors must be built on commonality degenerative factors and indicators to ensure succinctness and tenacity of the quotient formulae. The above formulae may not be applicable to all industries, but it serves as an implementation guidance that may be considered in changing one model of risk analytics to another model of risk analytics.

- Statistical Distribution Efficient factor

This is a data analytics efficiency factor that is used to posture the compartmental efficiency dynamics in the risk analyses populative difference between the enterprise risk analysis and the COVID-19 inspired risk analysis. This statistical distribution efficient factor is measured using different methods and or sets of indicators. Some of the methods are as follows:

- Datum line of skewness population.

- State of dentures in the risk analysis methodology.

- Stochastic modelling stress tests

- Efficiency dynamics as a percentage of rate of change of data algorithmic meaning velocity.

- Formulation tenacity: it is measured at the degenerative capability of data from the modus pock.

This paper has focused on the six principles to demonstrate methodologies that may be employed in the deployment of another methodology in the enterprise. This paper demonstrates methodologies for determining if enterprise risks are synonymous with COVID-19 inspired risks.

Stated below is an example of questions one may ask, decisions that may be made before ensuring that dual risk analyses; enterprise risk analyses and COVID-19 inspired risk analyses are quality assured.

1. Identify COVID-19 inspired risks:

- Is the identified COVID-19 inspired risk synonymous with existing and or forecasted enterprise risk?

- If the answer to bullet 1 is yes, identify key risk factors for the existing and or forecasted enterprise risk impacted by COVID-19.

- Identify, validate and evaluate assumptions and or key data supporting the aforesaid key risk factors.

- Map risk factors that are common for both existing and or forecasted enterprise risks and COVID-19 inspired risks thereto. Mapping involves linking the risk factors to the COVID-19 inspired risks synonymous or identified with existing and or forecasted enterprise risks. Here make a decision on whether the COVID-19 risk assessment is a baseline, tactical, project-based, regulatory or issue- based. [This is known as key data and or assumptions meshing method.

2. If the COVID-19 inspired risks are not the same as existing and or forecasted enterprise risks, perform the following:

- Identify key risk factors severally impacting COVID-19 inspired risks.

- Identify, validate and evaluate key data and or assumptions supporting the identified key risk factors (risk factors impacting COVID-19 inspired risks)

- Map identified risk factors to COVID-19 inspired risks, map identified risk factors to each of the existing and or forecasted enterprise risks.

- Decide whether the risk assessment for COVID-19 inspired risks and or existing and or forecasted enterprise risks is an issue-based risk assessment or other types of risk assessments such as baseline, regulatory, project risk-based or tactical

3. After having performed the above steps, perform risk assessment based on the following:

- COVID-19 inspired risks are not synonymous with existing and or forecasted enterprise risks.

- COVID-19 inspired risks are synonymous with existing and or forecasted enterprise risks.

- There are no COVID-19 inspired risks but there are issues inspired by COVID-19 inspired events.

Example: designed by Thomas Mutsimba

NB. Support decision steps from measurement of differences between COVID-19 inspired risk analysis and existing and or forecasted enterprise risk analysis using the Gap Identification Measurement technique that supports risk analyses in the COVID-19 era.

The thrust of paper is to direct considerations in the assessment of COVID-19 inspired risks as COVID-19 is a new event permeating the risk diametric universe of the enterprises. This guideline is not a cast in stone but provides immediate considerable foundation to circumvent the impending COVID-19 inspired risk universe.

Disclaimer: All views expressed in this article are my own and do not represent the opinion of an entity whatsoever, with which I have been, am now, or will be affiliated with. ©